POSCO is Korea’s top steelmaker and a global leader in the steel industry—but also the country’s largest industrial CO₂ emitter. Achieving carbon neutrality by 2050 will require a major shift in the steel sector, with hydrogen emerging as a key solution.

This report highlights the critical role of hydrogen in decarbonizing steel production, especially through hydrogen-based direct reduced iron (H2-DRI). It also explores how LNG and hydrogen can work together during the transition, supporting Korea’s broader energy transformation goals.

Executive Summary

Limitations of Green/Blue Hydrogen and the Strategic Role of Turquoise Hydrogen

- Current clean hydrogen policies, which have focused heavily on green and blue hydrogen, are facing practical limitations due to high costs and infrastructure constraints. As a result, private investment is weakening.

- To successfully establish a hydrogen economy, a technology-neutral system and a market structure centered around private sector and end-use companies must be adopted. Turquoise hydrogen aligns well with this paradigm.

- Turquoise hydrogen has low dependency on renewables and CCS, and can seamlessly integrate with existing industrial infrastructure, making it a promising technology for developing tailored clean hydrogen ecosystems across industries.

- Specifically, turquoise hydrogen is gaining attention as a realistic alternative because of its advantages in:

- Environmental performance

- Utilization economics

- Preventing industrial hollowing-out

- LNG synergy

- Solid carbon by-product utilization

✅ Key Advantages:

- Environmental Performance

Turquoise hydrogen emits solid carbon instead of CO₂, resulting in no direct emissions during the production phase. Indirect emissions are expected to gradually decline through further technology development and expanded use of clean electricity. - Economic Efficiency

In the usage phase, turquoise hydrogen is as cost-effective as green and blue hydrogen. Moreover, it offers additional economic advantages by generating value through solid carbon resource utilization. - Industrial Ecosystem Compatibility

Unlike green hydrogen, which requires large land areas for renewable energy infrastructure, turquoise hydrogen can be produced near industrial complexes, making it more responsive to the intermittency of renewables and helping to curb the offshoring of manufacturing. - LNG Integration

As demand for hydrogen grows in industrial and power generation sectors, leveraging existing LNG contracts to produce turquoise hydrogen can support economic and structural stability within the LNG supply chain. - Solid Carbon Utilization

The solid carbon produced can be used not only in conventional sectors like power generation and construction, but also in emerging high-value industries such as graphene, carbon nanotubes (CNT), and carbon fiber—boosting future advanced material sectors.

Global Policy Alignment and Strategic Timing

- Global energy policy is shifting from a technology-specific focus to carbon reduction outcomes. Turquoise hydrogen is increasingly being viewed as a carbon-effective solution, gaining international recognition and policy support:

- The U.S. IRA (Inflation Reduction Act) 45V and Japan’s Hydrogen Basic Strategy Article 3-6 both recognize methane pyrolysis-based turquoise hydrogen as a form of clean hydrogen.

- The EU’s draft delegated act also plans to include turquoise hydrogen under the low-carbon hydrogen category.

- While countries define “clean” or “low-carbon” hydrogen based on CO₂ emissions thresholds, support programs are expanding for first-of-a-kind decarbonization technologies, regardless of certification status.

Strategic Timing for National Investment and Technological Leadership

- Turquoise hydrogen currently sits at TRL (Technology Readiness Level) 4–8, indicating significant room for technological enhancement. Now is the optimal moment for national designation as a strategic technology and for early-stage investment.

- Given current technological maturity and national power grid constraints, achieving clean hydrogen certification may be difficult in the short term.

- However, by 2030, if the national power grid integrates more renewable generation, and if low-energy catalysts and solid carbon commercialization technologies are pursued as core strategic objectives, turquoise hydrogen could evolve from a transitional solution to a central pillar of the clean hydrogen economy.

1. What is Turquoise Hydrogen?

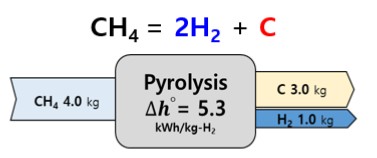

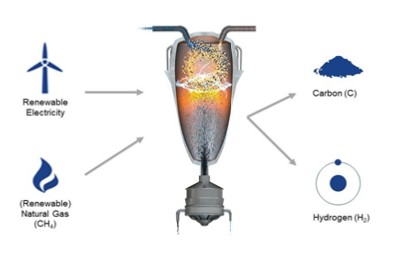

- Turquoise hydrogen is a form of hydrogen produced through the pyrolysis of methane (CH₄)—the main component of natural gas. During this thermal decomposition process, hydrogen is generated along with solid carbon (C) as a by-product, resulting in zero direct CO₂ emissions. It is classified as carbon-free hydrogen.

- The term “turquoise” represents a mix between blue and green—reflecting that turquoise hydrogen:

- Uses natural gas as feedstock, similar to blue hydrogen;

- Shares the zero-carbon characteristic of green hydrogen, since it does not emit CO₂ during production.

- Notably, the solid carbon by-product has advantages over CO₂ in both environmental management and industrial value. It can be transformed into high-value materials, enhancing not only the economic viability of hydrogen production but also its industrial ripple effects.

- Solid carbon, being a pure elemental solid, is easier to handle and store than gaseous CO₂, which readily combines with oxygen and requires complex containment solutions.

- It has broad industrial applications, including:

- Carbon black and coke;

- Advanced materials like graphene and carbon nanotubes (CNTs), which are key enablers in high-tech sectors.

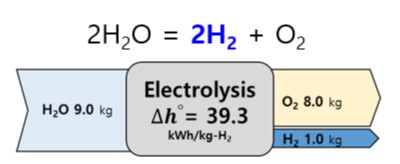

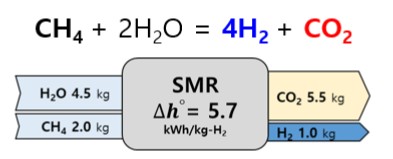

| Aspect | Green Hydrogen | Blue Hydrogen | Turquoise Hydrogen |

|---|---|---|---|

| Chemical Reaction (Theoretical) |  |  |  |

| Technology Readiness Level (TRL) | TRL 8-9 | TRL 7-9 | TRL 4-8 |

| H2 Production (Output) | 1kg – H2 | 1kg – H2 | 1kg – H2 |

| (1-1) Law Material (Input) | Pure Water(10kg) | Pure Water(4.5kg) + CH4(2kg) (SMR : Steam Methane Reforming) | CH4(4kg) (Methane use increases as water is not used) |

| (1-2) Energy (Actual) | E = 57kwh/kg-H2 (Required High E. Consumption during Water Electrolysis Process) | E = 40kwh/kg-H2 (High Temp. & Pressure required for Steam Water) | E = 10 ~ 35kwh/kg-H2 (Various E. Range depending on technology) |

| (1-3) By – Products | CO2 – None O2 – Pure Oxy Fuel – Using | CO2 – 11kg/H2 – kg | CO2 – None C – Solid (Commercial) |

| (1-2) Carbon Emissions | Very low, but dependent on clean electricity availability | Lowered by CCS, but not zero | Produces solid carbon instead of CO₂—easier to handle & sequester |

| (1-3) Energy Efficiency | Electrolysis is energy-intensive | Higher efficiency than electrolysis | Highly efficient, with lower parasitic load |

| Infrastructure Compatibility | Requires new electrolysis and grid capacity | Can reuse gas infrastructure | Leverages existing gas pipelines & LNG logistics |

| Environmental Impact | Low, but high water & land use | CO₂ leakage risk in CCS | Avoids CO₂ emissions entirely; solid carbon has industrial use potential |

| Economic Viability | Expensive due to renewables demand | Moderate, but CCS is costly | Cost-effective if methane pyrolysis is optimized; synergies with LNG lower capex/opex |

Turquoise Hydrogen as a Practical Energy Alternative

- Turquoise hydrogen can serve as a realistic driver of the hydrogen economy in countries like small size land(S. Korea), where renewable energy and CO₂ storage environments are limited, by complementing the shortcomings of green and blue hydrogen.

- Unlike blue hydrogen, which requires significant CO₂ storage capacity, turquoise hydrogen relies on solid carbon, which is easier to manage through domestic site storing.

- In addition, compared to green hydrogen, turquoise hydrogen has higher energy efficiency and lower consumption of electricity and water, making it more economical and feasible as a domestic production model.

- Energy consumption for turquoise hydrogen production is about 10–35 kWh per kg H₂, which is only 20–60% of green hydrogen’s requirement, and since it does not use water as a feedstock, there is less burden on water resources.

Global Trends in Strategic Support for Turquoise Hydrogen

- United States:

- Even during the Trump administration, support for hydrogen linked to LNG is maintained, and turquoise hydrogen is recognized for its low-cost production potential.

- The final IRA 45V guidelines (effective Jan. 2025) explicitly include methane pyrolysis (the core technology for turquoise hydrogen) as eligible for support.

- The U.S. Department of Energy (DOE) has highlighted turquoise hydrogen’s economic and environmental potential, allocating 0.7% of its total loan program budget—about half the level of green hydrogen’s funding share (50%).

- Japan:

- As an LNG-importing country like Korea, Japan designates methane pyrolysis as one of its four key innovation technologies in its Basic Hydrogen Strategy.

- Major industrial players—including Sojitz (Ebara), Mitsubishi, Sumitomo, Miura Industries, Okinawa Electric, Tokyo Gas, and the Japan Iron and Steel Federation—are actively expanding R&D.

- Once development moves into the demonstration phase, Japan’s Ministry of Economy, Trade, and Industry plans to expand support to include large-scale pilot projects via its Green Innovation Fund (GI Fund).

- European Union (EU):

- Through the Low-Carbon Fuel Delegated Act, the EU plans to classify turquoise hydrogen as low-carbon hydrogen and establish a formal basis for support.

- As long as turquoise hydrogen meets the carbon emission threshold (≤ 3.38 kg CO₂/kg H₂), it will be included—alongside green, blue, and nuclear hydrogen—under the mandatory usage and support mechanisms such as contracts for difference.

2. (S. Korea’s Plan) Turquoise Hydrogen and Hydrogen Economy 3.0

- In 2019, Korea launched the Hydrogen Economy Roadmap, marking the beginning of Hydrogen Economy 1.0, focused primarily on mobility. In 2021, with the enforcement of the Hydrogen Act, Korea entered Hydrogen Economy 2.0, aiming to establish a supply base for clean hydrogen.

- During Hydrogen Economy 1.0, the focus was on expanding hydrogen demand through the adoption of hydrogen vehicles and fuel cell technologies, primarily in the mobility sector.

- In Hydrogen Economy 2.0, efforts centered on introducing a clean hydrogen certification system, fostering collaboration between the public and private sectors to build a global clean hydrogen supply chain, and facilitating a shift toward a clean hydrogen economy.

- Beyond Hyundai Motor Group, major conglomerates such as SK, Lotte, Hanwha, POSCO, and Doosan joined Korea’s hydrogen economy initiatives.

- However, Hydrogen Economy 2.0 has faced limitations due to challenges in economic viability, stringent certification requirements, and insufficient infrastructure development, which failed to attract significant private investment.

- Strict certification conditions for clean hydrogen have led to higher-than-expected production costs, while the lack of concrete policy and financial support has discouraged private sector participation.

- In the 2024 Clean Hydrogen Power Standard (CHPS) competitive bidding process, unexpectedly high prices for hydrogen and ammonia resulted in weak private sector engagement.

- Similar issues are observed not only in Korea but also in the EU and the U.S., where many hydrogen projects have been delayed or canceled due to concerns over realistic economic feasibility.

3. Why Turquoise Hydrogen Deserves Attention

(1) A Potential Clean Hydrogen Contributing to Carbon Neutrality

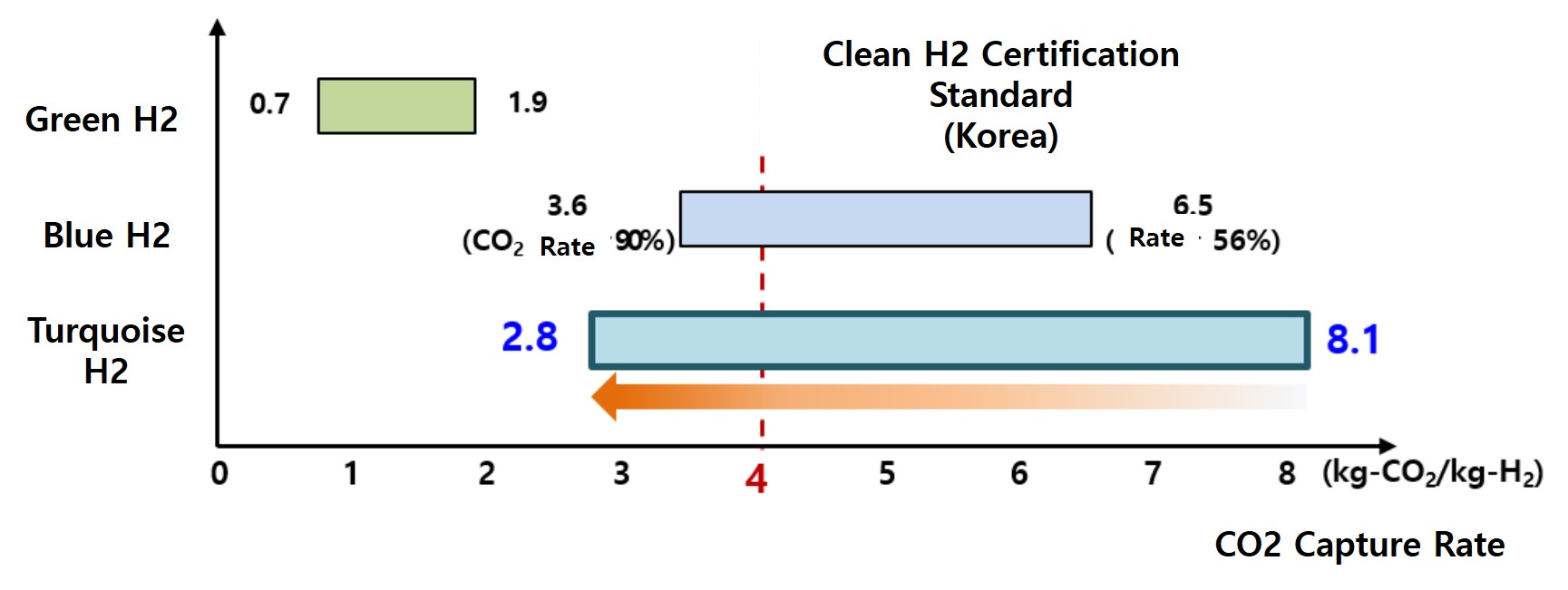

- At the current technological level, turquoise hydrogen does not directly emit CO₂ during the production process. However, due to indirect CO₂ emissions from natural gas extraction, transportation, and methane pyrolysis, it exceeds the clean hydrogen certification threshold of 4 kg CO₂ per kg H₂.

- The clean hydrogen certification system measures CO₂ emissions from well-to-gate (WtG), covering the entire chain from feedstock extraction to hydrogen production.

- Turquoise hydrogen has no Scope 1 emissions (direct CO₂ from the pyrolysis process itself), but when including:

- Scope 2: CO₂ from the electricity used in pyrolysis, and

- Scope 3: CO₂ from natural gas extraction and liquefaction,

total emissions surpass the clean hydrogen certification standard.- [Figure] CO₂ Emissions by Hydrogen Production Technology (Well to Gate Basis) (Ref. ) Reconstructed by POSRI based on sources from KIER (Korea Institute of Energy Research), Advanced Institute of Technology, etc.

: * Reconstructed by POSRI based on sources from KIER (Korea Institute of Energy Research), Advanced Institute of Technology, etc.

: * Reconstructed by POSRI based on sources from KIER (Korea Institute of Energy Research), Advanced Institute of Technology, etc.- By contrast, blue hydrogen uses steam methane reforming (SMR), where hydrogen is produced not only from natural gas (CH₄) but also from water (steam, H₂O).

- In comparison, turquoise hydrogen relies solely on natural gas as a feedstock, meaning that to produce the same amount of hydrogen, it requires twice as much natural gas as blue hydrogen.

- In Korea’s case, since natural gas must be imported in liquefied form (LNG), the liquefaction process alone adds approximately 2 kg CO₂ per kg H₂ (Scope 3).

✅ Point:

- Turquoise hydrogen = CO₂-free at the process level (Scope 1).

- But Scope 2 & Scope 3 emissions (electricity mix, gas supply chain) push it beyond current clean hydrogen certification thresholds.

- For LNG-importing countries like Korea, extra LNG-related emissions further weaken the certification profile.

Prospects for Clean Hydrogen Certification by 2030

- By 2030, with the development of low-energy catalyst technologies and the expansion of carbon-free power sources in the national electricity mix, it is expected that turquoise hydrogen will be able to meet clean hydrogen certification standards.

- First, since turquoise hydrogen’s energy requirements vary depending on the technology used, the development of low-energy catalysts and low-carbon process technologies can reduce overall CO₂ emissions.

- The high-temperature plasma method, which is close to commercialization, requires around 35 kWh per kg H₂. If powered by the current grid (with only 33.8% carbon-free generation), this results in approximately 16 kg CO₂ per kg H₂ (Scope 2).

- However, if low-temperature plasma or molten metal catalyst methods are developed, energy requirements could be reduced to 10 kWh per kg H₂, lowering emissions to 4.7 kg CO₂ per kg H₂, though there may be challenges with solid carbon purity.

- Second, if by 2030 the national grid’s GHG emission factor decreases to 0.2 kg CO₂/kWh, turquoise hydrogen’s emissions could fall within clean hydrogen certification standards.

- Currently, with 33.8% carbon-free generation, the grid’s emission factor is 0.47 kg CO₂/kWh. Even at the minimum energy use (10 kWh/kg H₂), turquoise hydrogen emits 4.7 kg CO₂ per kg H₂ (Scope 2)—above the certification threshold.

- According to the 11th Basic Plan for Long-Term Electricity Supply and Demand, the share of carbon-free power is expected to increase to 53% by 2030, reducing the emission factor to around 0.24 kg CO₂/kWh. By 2038, this is expected to fall below 0.2 kg CO₂/kWh, which would reduce turquoise hydrogen’s Scope 2 emissions to about 2.0 kg CO₂ per kg H₂.

- Third, depending on how global turquoise hydrogen projects are designed—such as expanding LNG import contracts in countries increasing zero-carbon power—upstream emissions, currently about 3.7 kg CO₂/kg H₂, can be reduced by 10–70%.

- First, since turquoise hydrogen’s energy requirements vary depending on the technology used, the development of low-energy catalysts and low-carbon process technologies can reduce overall CO₂ emissions.

- If all the above conditions are met, turquoise hydrogen can reduce CO₂ emissions to as low as 2.8 kg CO₂/kg H₂, offering better reduction performance than blue hydrogen.

- [Figure] Overview of Turquoise Hydrogen Technologies and Required Energy

| Technology | Plasma Pyrolysis Technology | Catalytic Decomposition Technology | Molten Metal Catalytic Decomposition Technology |

|---|---|---|---|

| Overview (Figure) |  |  |  |

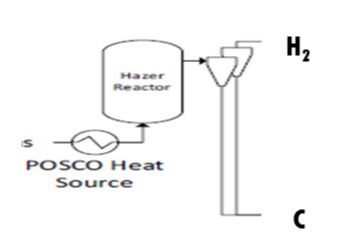

| Description | A technology that directly decomposes methane via high-temperature plasma (e.g., microwave or arc plasma) | Methane is decomposed as it passes through a catalyst bed at high temperature | Methane is injected as bubbles into molten metal, where it decomposes via reaction with liquid metal catalysts |

| Energy Required | 35 kWh/kg-H₂ (microwave plasma) 13 kWh/kg-H₂ (arc plasma) | 10 kWh/kg-H₂ (Hazer process) | 11 kWh/kg-H₂ (C-jet process) |

(2) From a hydrogen utilization perspective, it is also more economical.

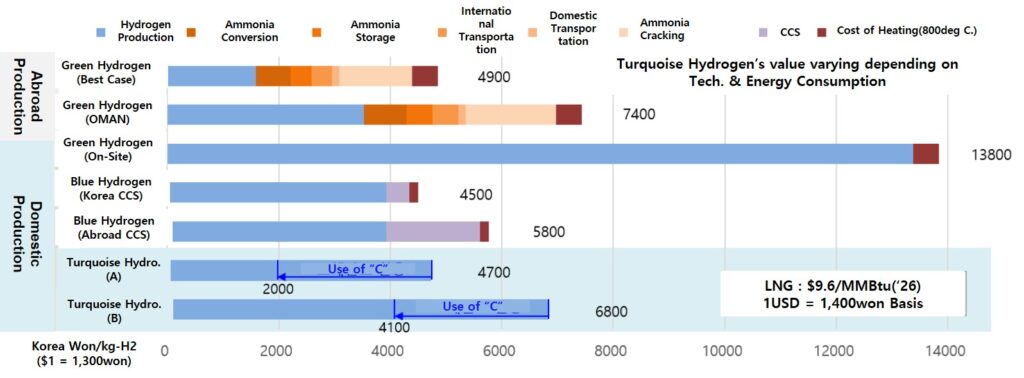

○ Green hydrogen can be produced economically in countries with strong renewable energy resources, but high transport costs make the final price at the point of use rise to around 4 to 5.5 USD/kg.

○ Since green hydrogen must be converted into ammonia for transport and cracked domestically, costs exceed production levels, making it hard to adopt for domestic applications.

- For example, even if hydrogen is produced for under 4,000 KRW/kg(Approx. $3/kg) in Oman through a 2028 project, the import cost to Korea rises to over 7,000 KRW/kg(Approx. $5.5/kg) .

- In industrial applications like hydrogen-based steelmaking, additional energy is required for reheating, pushing the cost to at least the mid-7,000 KRW/kg(Approx. $5.5/kg) range for companies.

○ Even in the most optimistic future scenario, hydrogen production costs may fall below 2,000 KRW/kg, but high transport costs remain a major hurdle—raising final prices for hydrogen users to around 5,000 KRW/kg.

[Figure 5] Hydrogen production, transport, and utilization costs by technology

Source: POSRI, based on data from Roland Berger, IEA, Mirae Asset Securities, etc.

○ Blue hydrogen benefits from existing LNG infrastructure, so transport costs are relatively low. However, due to LNG purchase prices and overseas CO₂ storage expenses, final prices rise to 4,000–6,000 KRW/kg.

- For example, if LNG is imported at USD 10/MMBtu and CO₂ is stored domestically near the East Sea, usable hydrogen can be secured at mid-4,000 KRW/kg.

- But due to limited domestic storage and public resistance, overseas storage becomes necessary, pushing final costs closer to 6,000 KRW/kg.

○ Turquoise hydrogen is similarly priced at 4,000–7,000 KRW/kg, but has the potential to fall to 2,000–3,000 KRW/kg depending on how solid carbon byproducts are utilized.

- While CCS is not required for turquoise hydrogen, it uses about twice as much natural gas as blue hydrogen, increasing costs.

- However, some technologies (TRL 4–8) already allow production in the 4,000 KRW/kg range. If the solid carbon is refined and sold into high-value industries, production costs can drop further.

- Producing 1 kg of hydrogen yields 3 kg of solid carbon. If 15% is used in high-value materials (e.g., graphene, carbon black) and 85% in general industry, recovery of 2,000 KRW/kg is possible.

- Even if LNG prices rise in the future, profitability can be improved depending on how the carbon is used.

(3) Complementing the Green Hydrogen Supply Chain & Preventing Domestic Industrial Hollowing-Out

○ Expanding a green hydrogen-based domestic ecosystem presents challenges: land acquisition for renewables, long-distance transmission lines, social acceptance, and weather-driven intermittency—all of which destabilize the hydrogen supply chain.

- For example, to produce 110,000 tons of hydrogen near industrial complexes, solar PV fields over 290 hectares (equal to Yeouido area) are needed.

- Onshore wind power requires even more land—about 6x more than solar—due to spacing requirements between turbines to prevent wake effects.

- Building renewables far from industrial areas requires high-voltage, long-distance transmission, raising costs and facing local opposition.

○ If green hydrogen is produced abroad, high transport costs make domestic usage unattractive, prompting companies to consider relocating facilities overseas.

- For instance, refiners producing e-fuels and steelmakers deploying hydrogen-based DRI require green hydrogen as a core input.

- E-fuels are synthesized from hydrogen and CO₂ for land/sea/air transport, while hydrogen DRI replaces coal/Natural Gas in steel production.

- However, domestic operations may be economically unviable due to hydrogen transport costs—causing a shift in investment overseas.

○ Turquoise hydrogen, using existing LNG infrastructure, offers flexible domestic supply in cases where green hydrogen is difficult to scale, contributing to a resilient clean hydrogen supply chain.

- Unlike green hydrogen, it can be directly used in high-temperature processes without landfill CO₂ storage.

- Turquoise hydrogen can be efficiently integrated into foundational industries without major infrastructure changes (e.g., ships, tanks, terminals, pipelines remain usable).

(4) Synergy Through Strategic LNG Utilization

○ Despite many long-term, high-volume LNG contracts being signed, LNG demand is projected to decline after 2030, raising concerns over surplus LNG.

- According to Korea’s 11th Basic Power Supply Plan, LNG’s share in power generation remains at 25.1% until 2030, but drops to 10.6% by 2038.

- Meanwhile, LNG prices are expected to rise steadily post-2030. If long-term contracts are reduced in favor of spot purchases, Korea may face higher LNG import prices.

○ Producing turquoise hydrogen offers a stable use case for LNG, supporting long-term procurement strategies and reinforcing the hydrogen economy.

- As hydrogen demand grows in industrial and power sectors, turquoise hydrogen can bridge clean hydrogen initiatives and long-term LNG contracts.

- In steelmaking, turquoise hydrogen is needed for low-carbon steel and reducing agents. In power generation, blending turquoise and blue hydrogen helps meet carbon neutrality targets while offering strategic flexibility.

(5) Fostering a High-Value Solid Carbon Industry

○ Solid carbon co-produced with turquoise hydrogen is usable across multiple industries, including steel, power, and construction—as a fuel or reinforcing agent.

- Even in hydrogen-based steelmaking, carbon is essential for carbon steel production.

- Applications include coke for blast furnaces, electrodes for electric arc furnaces, and binders for DRI pellets.

- Japan is also considering using solid carbon as a coal substitute in power plants.

- In construction, carbon can be used as a structural additive in concrete.

- Japan is testing its use in 170 million tons of annual concrete output.

○ Solid carbon can be refined into advanced materials like carbon black, graphite, and carbon nanotubes (CNTs).

- Carbon black (avg. price $1.1/kg) is widely used in tires, pigments, and plastics.

- Solid carbon is also a next-gen material for batteries, electronics, and medical devices (e.g., 126k tons graphite, 55k tons CNTs annually).

- The carbon fiber market is expected to triple by 2035, with rising demand in aerospace, wind turbine blades, hydrogen tanks, and EV lightweighting.

- Companies like Joby Aviation (US) and Ehang (China) are using carbon fiber for eVTOL aircraft.

- ExxonMobil is developing technology to convert pyrolysis carbon into carbon fiber.

4. Recommendations for Developing the Turquoise Hydrogen Ecosystem

○ Turquoise hydrogen is not just a bridge to green hydrogen but a realistic pillar of a clean hydrogen ecosystem and needs strategic and institutional support alongside green and blue hydrogen.

- It is the “third hydrogen,” offering both environmental and economic advantages.

- Besides stabilizing green hydrogen supply chains, it also supports solid carbon industry development.

(1) Secure National Strategic Technology Status

- As turquoise hydrogen is in TRL 4–8 and no country has taken the lead, securing national designation can position Korea as a global clean hydrogen leader.

- Currently, only green and blue hydrogen are designated as national strategic technologies.

- This designation offers tax, funding, and permitting support for tech independence and supply chain security.

○ Aiming for clean hydrogen certification will enable coexistence with green hydrogen and industry leadership in both hydrogen and carbon materials.

- Even before certification, methane pyrolysis and carbon recycling policies can help build the ecosystem.

- Due to its diverse technical routes (e.g., plasma, metal catalyst, molten salt), turquoise hydrogen requires strategic national support across solid carbon applications.

○ If certification standards are not yet met but carbon reduction over gray hydrogen is proven, temporary incentives should be considered.

- For instance, under the U.S. Industrial Demonstration Program, new low-carbon tech like hydrogen can receive CAPEX support even without clean hydrogen certification.

- Standards might be temporarily eased if solid carbon is treated not as a byproduct but a co-product, dividing CO₂ emissions accordingly.

- Conventionally, all CO₂ from WtG (Well-to-Gate) processes was assigned to turquoise hydrogen, leading to overestimated emissions.

(2) Build Intensive Support Systems from R&D to Commercialization

○ As high purity is not required for industrial/power use, turquoise hydrogen is well-suited for industrial zones, where pilot projects can accelerate commercialization.

- Pilot projects can validate large-scale production and help reduce costs to acceptable levels.

- Producing 110,000 tons of hydrogen yields 330,000 tons of carbon, requiring collaboration on purification and utilization.

- Link to hydrogen pilot cities to expand from R&D to real-world demonstration and deployment.

5. Summary & Implications

○ As the hydrogen economy enters a transition phase, advancing to Hydrogen Economy 3.0 requires a self-sustaining ecosystem and greater support for technologies preferred by demand-side industries.

- Although driven by global regulation, practical deployment needs market-aligned technology backing.

○ Alongside green hydrogen, securing a diverse hydrogen technology portfolio—especially those linked to LNG—is essential. Turquoise hydrogen, with favorable tech leadership potential, deserves focused attention.

○ Given its synergy with solid carbon—a future high-value material—turquoise hydrogen will grow from a transitional to a foundational clean hydrogen pillar.

Link:https://www.posri.re.kr/kor/bbs/bbs_list.do?s_hash=%EC%B2%AD%EB%A1%9D%EC%88%98%EC%86%8C